Am I Covered for Mental Health Treatment?

Mental illness has historically been a very difficult topic to discuss. Not just from a societal standpoint, but from an insurance one as well. It’s been quite taboo to share mental illness difficulties, or trips to the doctor for those difficulties with the greater public. Thankfully, this nuance has gotten progressively better over the years.

Mental Health Problem

Not only are people discussing openly things like opioid addiction, but there has been legislative action to force insurance carriers to treat mental illness like any other physical illness. In the past, insurance carriers could bifurcate mental and physical illness; treating one more favorable than the other. For example, a carrier could pay 80% of a covered physical illness claim, but 50% of a mental illness one. The Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA) addressed this very issue, among several others. MHPAEA, passed in 2008, is a federal law that generally prevents group health plans and health insurance issuers that provide mental health or substance use disorder (MH/SUD) benefits from imposing less favorable benefit limitations on those benefits than on medical/surgical benefits.

Mental Illness Coverage Status

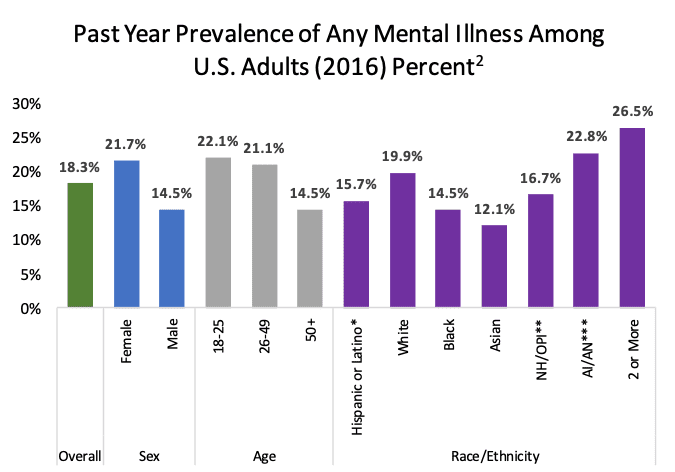

The MHPAEA couldn’t come soon enough as mental illness continues to be a prevalent ailment affecting our society. As the graph below illustrates, almost one fifth of the adult population in the U.S. are dealing with some form of mental illness. It’s almost unfathomable that mental health treatment wasn’t adequately protected prior to the MHPAEA. A large subset of mental illness which also plagues our society, and equally benefits from MHPAEA is addiction. Over 100 people die every day from drug overdoses, and over 20 million Americans over the age of 12 have an addiction. Although distinctly different, there is certainly overlap between mental illness and addiction. Now, both can be treated just like any physical illness.

Does My Health Plan Cover Mental Health Treatment?

More specifically, the MHPAEA levels the playing field regarding carriers paying mental health claims at the same rate and according to the same parameters as they pay physical illnesses through addressing the following:

- The number of days you can stay in the hospital

- The frequency of treatment

- Out-of-pocket maximums

- Co-Payments

- Co-insurance

- Deductibles

Healthcare carriers must have the same pricing, frequency of service, and any other benefits provided (many mentioned above) be the same for physical and mental illness claims. Also, the MHPAEA directly applies to:

- Employer based health plans (only companies with 50 or more employees)

- Health coverage purchased on the healthcare exchange

- The Children’s Health Insurance Program (CHIP)

- Medicaid

Thus, if you have obtained health insurance coverage through any one of the means listed above, there’s a strong likelihood that you carry mental health treatment coverage.

The MHPAEA has certainly helped progress how we view mental illness and cover it regarding insurance. Although the Act does level the playing field as it relates to physical and mental illness coverage, make sure you check your individual policy for coverage benefits to ensure you are covered for any mental illness claims you may have in the future. Stay healthy, physically and mentally!

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE